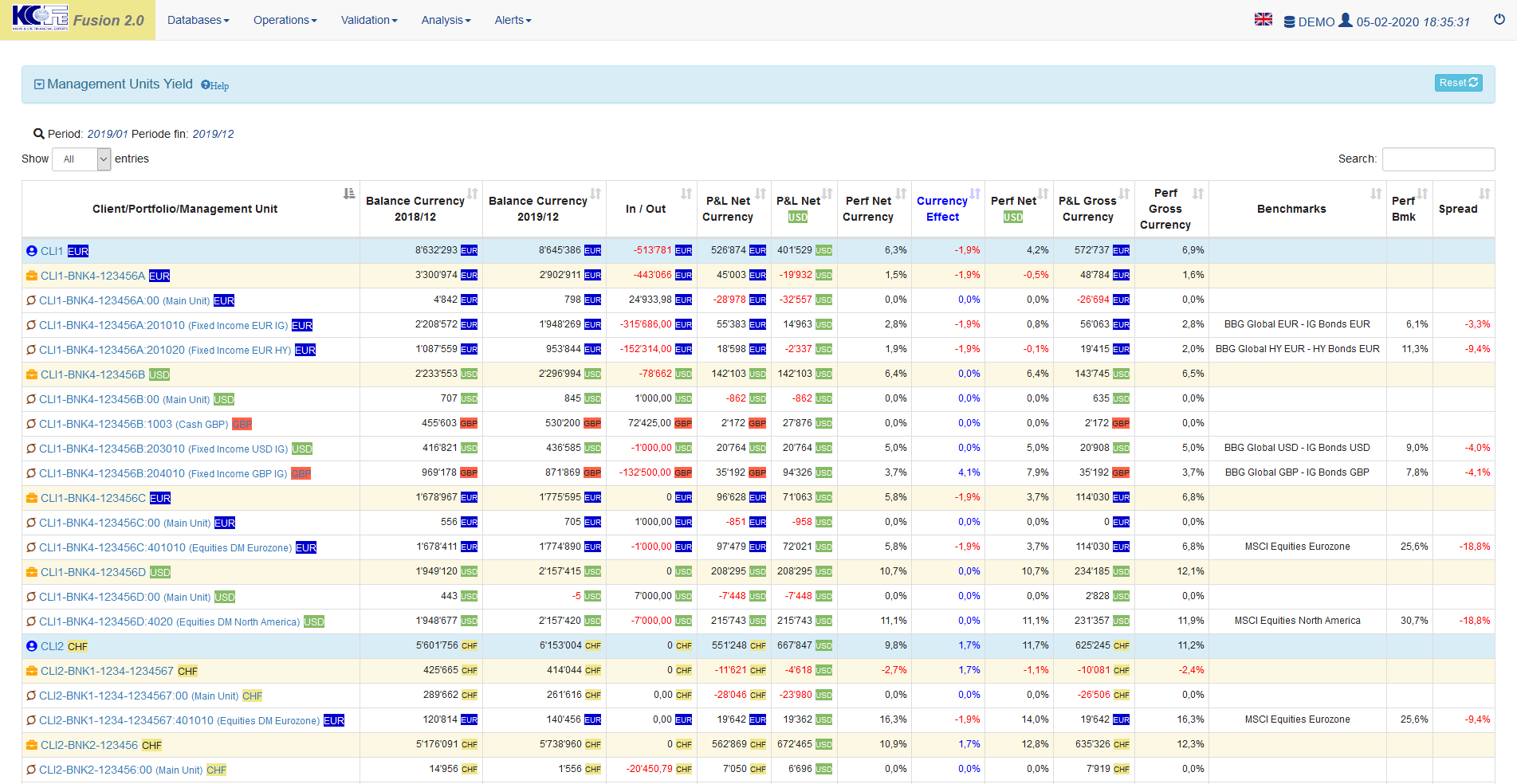

Management Units Yield

Performance of client, portfolio and each management units

Management Units selection

Select management units with selection boxes

Date selection

By default the management units yield is calculated from year start until today

Enter a valid historical booking period (YYYYMM format) in Period and Period End boxes to obtain a yield calculation between 2 periods

Currency selection

The management units yield is calculated in the currency selected by the Currency box

Detailed view

Data table

- Client/Portfolio/Management Unit = yield consolidation level, either client, portfolio or management unit

- Balance Currency = balance in currency at the displayed period

- In / Out = total of in / out transactions (without impact on performance) between calculation periods

- P&L Net Currency = net total profit and loss in consolidation level currency

- P&L Net = net total profit and loss in calculation currency

- Perf Net Currency = net yield in consolidation level currency

- Currency Effect = spread between net yield in calculation currency and consolidation level currency

- Perf Net = net yield in calculation currency

- P&L Gross Currency = gross profit and loss, not taking into account bank fees and taxes, in consolidation level currency

- Perf Gross Currency = gross yield, not taking into account bank fees and taxes, in consolidation level currency

- Benchmark = asset class yield measurement index

- Perf Bmk = benchmark yield, in consolidation level currency

- Spread = spread between benchmark yield and gross yield in consolidation level currency

Calculations

- P&L Net = value [quantity x (price + accrued interest)] + sum (incomes [sales, dividends, coupons, …]) – sum (costs [purchases, …])

- P&L Gross = value [quantity x (price + accrued interest)] + sum (incomes [sales, dividends, coupons, …]) – sum (costs [purchases, …] excluding bank fees and taxes)

- Yield calculated according to the “Modified Time Weighted” method, the ins / outs of the period are divided for half at the beginning of the period and for half at the end of the period