Securities yield

Individual performance of each security trade

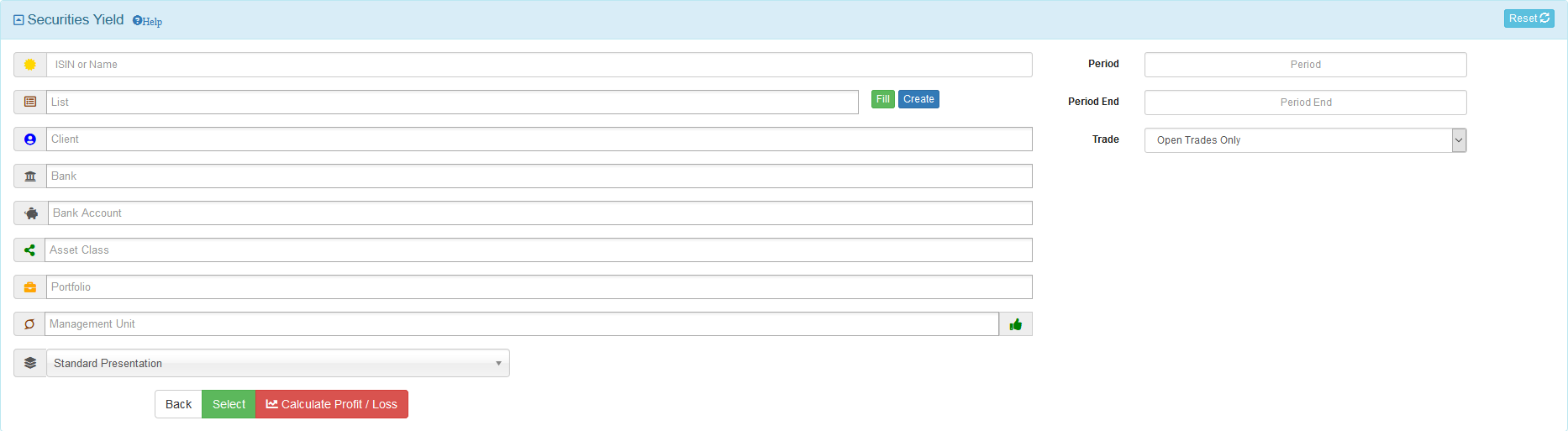

Securities selection

Select securities with selection boxes

Date selection

By default the securities yield is calculated from the trade opening until today

Enter a valid historical booking period (YYYYMM format) in Period and Period End boxes to obtain a yield calculation between 2 periods

- Period empty – Period End not empty = yield calculation from trade opening until end of Period End

- Period not empty – Period End empty = yield calculation from the start of Period until today

- Period not empty – Period End not empty = yield calculation from the start of Period until end of Period End

Trades selections

By default only open trades are displayed

Select trades to display with Trade box

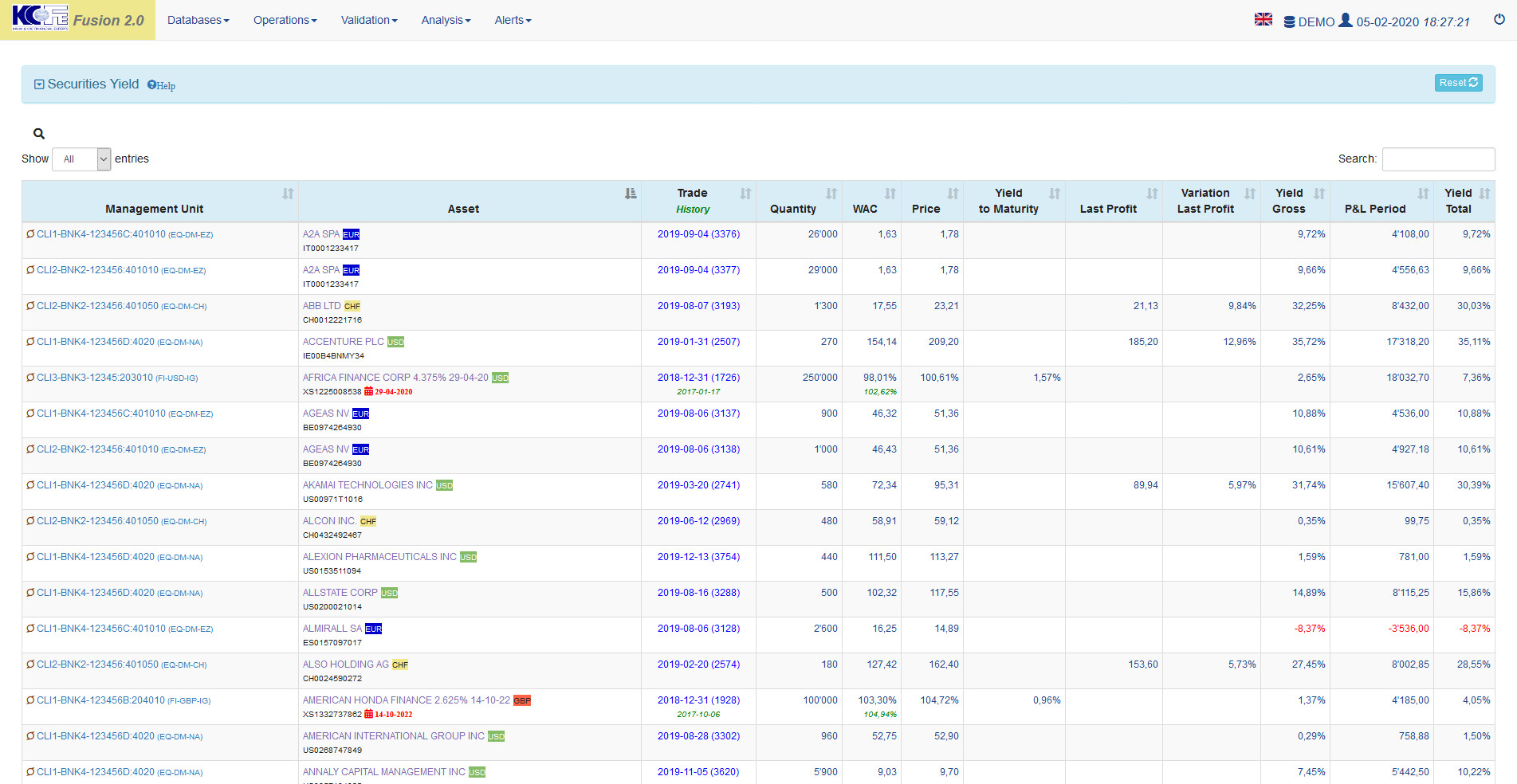

Detailed view

Data table

- Management unit = management unit code

- Asset = asset denomination, currency, ISIN code

- Trade = trade code (opening date d’ouverture and reference code)

- Trade history = imported trade historical opening date

- Quantity = asset quantity

- WAC = asset Weighted Average Cost

- Price = asset valuation price

- Yield to Maturity = final yield of the asset held until maturity based on its price

- Last Profit = price of the last take profit

- Variation Last Profit = gross yield since last profit

- Yield Gross = gross yield

- P&L Period = total profit and loss over the analyzed period

- Yield Total = trade total yield

Calculations

- Weighted Average Cost = Sum (purchase costs) / Sum (purchase quantities)

- Gross yield = (price + accrued interest) / (weighted average cost)

- P&L Period = value [quantity x (price + accrued interest)] + sum (incomes [sales, dividends, coupons, …]) – sum (costs [purchases, …])

- Total yield = P&L Period / (quantity x weighted average cost)