Management Report

Management report for client, portfolio and each management units

Management units selection

Select management units with selection boxes

Summary view

Data table

- Analysis of = client, portfolio or management unit selected for report

- Currency = report currency, reference currency for selected client, portfolio or management unit

- Period = start and end report perdiods

- Capital at Start = capital at start of report start period

- Capital at End = capital at end of report end period

- In / Out = total of in / out transactions (without impact on performance) between calculation periods

- P&L Net = net total profit and loss in report currency

- Perf Net = net yield in report currency

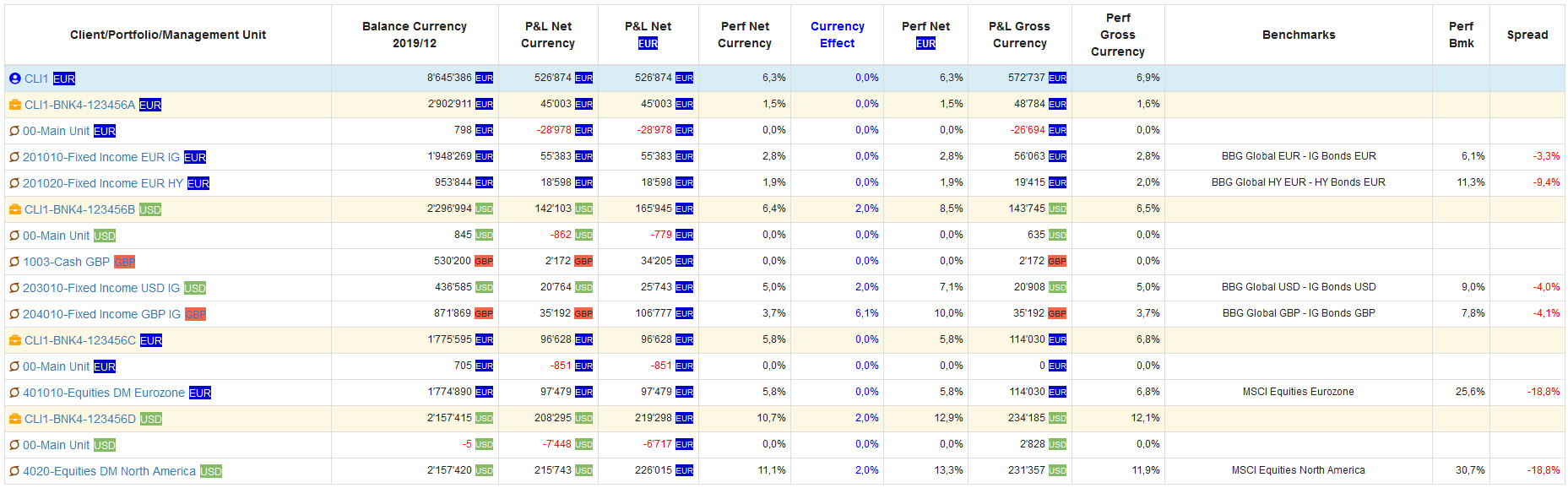

Detailed view

Data table

- Client/Portfolio/Management Unit = yield consolidation level, either client, portfolio or management unit

- Balance Currency = balance in currency at the displayed period

- P&L Net Currency = net total profit and loss in consolidation level currency

- P&L Net = net total profit and loss in report currency

- Perf Net Currency = net yield in consolidation level currency

- Currency Effect = spread between net yield in calculation currency and consolidation level currency

- Perf Net = net yield in report currency

- P&L Gross Currency = gross profit and loss, not taking into account bank fees and taxes, in consolidation level currency

- Perf Gross Currency = gross yield, not taking into account bank fees and taxes, in consolidation level currency

- Benchmark = asset class yield measurement index

- Perf Bmk = benchmark yield, in consolidation level currency

- Spread = spread between benchmark yield and gross yield in consolidation level currency

Calculations

- P&L Net = value [quantity x (price + accrued interest)] + sum (incomes [sales, dividends, coupons, …]) – sum (costs [purchases, …])

- P&L Gross = value [quantity x (price + accrued interest)] + sum (incomes [sales, dividends, coupons, …]) – sum (costs [purchases, …] excluding bank fees and taxes)

- Yield calculated according to the “Modified Time Weighted” method, the ins / outs of the period are divided for half at the beginning of the period and for half at the end of the period

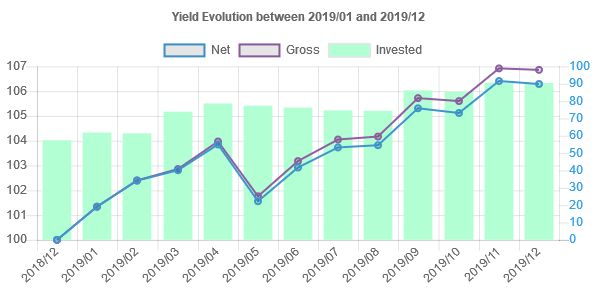

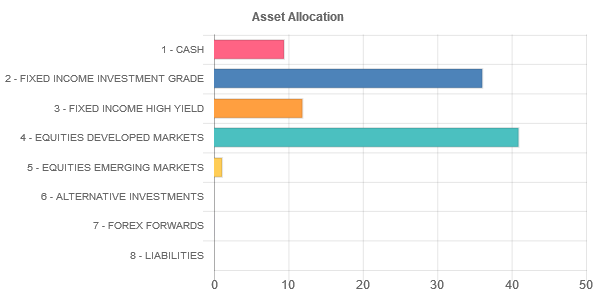

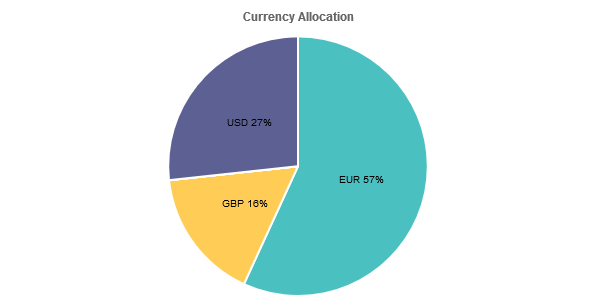

Charts

Assets evolution (see Management Units Evolution)

Current assets breakdown by broad classes

Current assets breakdown by currency